BUSINESS METHODS IN THE COURTS: Back in 2001, business method patents in the U.S. peaked at 8,700. According to The Wall Street Transcript, business method applications averaged over 6,000 each year since then. Most of these applications are being filed by financial services companies and cover practices revolving around smart card technologies, brokerage systems, trading systems, sales and marketing systems, and bill payment systems. However, many of these patents still haven't issued and have not yet been challenged in court.

A number of cases made the headlines recently that highlight the use of patents in the business world. The first one involves business intelligence software giants (and bitter rivals) MicroStrategy and Business Objects. Fresh from escaping infringement alleged by Business Objects, MicroStrategy retaliated by suing Crystal Decisions, Inc. a day before they knew Business Objects was buying the company. MicroStrategy alleged that Business Objects (formerly Crystal Decisions) infringed:

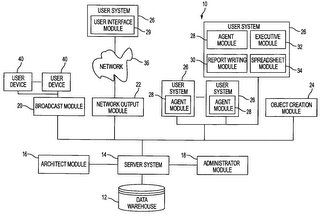

- US Patent No. 6,279,033 - System and method for asynchronous control of report generation using a network interface;

- US Patent No. 6,567,796 - System and method for management of an automatic OLAP report broadcast system ; and

- US Patent No. 6,658,432 - Method and system for providing business intelligence web content with reduced client-side processing.

Yesterday it was announced that District Judge Kent Jordan in Delaware ruled on Summary Judgment that two of the patents were invalid because products that practice the patented technology were in public use before patent applications were filed. Regarding the third patent, the judge also ruled that Business Objects didn't infringe because certain features recited in the patent were not found in product offered by Business Objects.

It is important to note that the process of invalidating business method patents will often include a thorough vetting of actual products that were available prior to the filing of a specific patent. Since there are few patents that issued between 1998-2002, it is typically more difficult to get a clear understanding of the prior art simply by using patent searches. Similarly, technical publications are also hard to come by in this time period - this is why product knowledge can be crucial in defending a patent infringement lawsuit.

In a second case, LendingTree, LLC was found by the U.S. District Court of Delaware to have willfully infringed U.S. Patent No. 5,995,947, issued to IMX, Inc. IMX was awarded $5,794,400 in damages and the company anticipates that the Court will issue an injunction to stop LendingTree's infringement. The patent provides an Internet-accessible, interactive, real-time network whereby borrowers and lenders exchange information in the pursuit of securing a loan.

Two interesting things about the IMX patent. First, the '947 patent, which clearly recites a business method, was filed on September 12, 1997 - State Street v. Signature Financial Group wasn't decided until July 23, 1998. So much for business methods being "illegal" (as the FFII likes to say) prior to State Street.

Second, the scope of the claims in the '947 patent appear very broad:

1. A method for processing loan applications, said method including the steps of maintaining a database of pending loan applications and their statuses at a database server, wherein each party to a loan can search and modify that database consistent with their role in the transaction by requests to said server from a client device identified with their role.

I have a feeling that we haven't heard the last of IMX . . .

As a side-note, DataTreasury continues to rumble through the check-processing industry. Yesterday, NCR Corporation settled pending litigation regarding DataTreasury's "check 21" patents by cross-licensing certain patents from NCR's portfolio, and paying an undisclosed amount of money. This follows settlements DataTreasury has already obtained with JPMorgan Chase, Bank One, Groupe Ingenico, NetDeposit, Inc., and RDM Corporation, companies that now license DataTreasury's patents. DataTreasury's pending infringement lawsuits include actions against Citibank, Bank of America, Wells Fargo and Wachovia.

Post a Comment